40 is service revenue an asset

Details for Service Revenue Liability Or Asset Or Equity ... Is Service Revenue an Asset? Breaking down the Income ... tip . Service revenue is the income a company generates from providing a service. The amount is displayed at the top of an income statement and is added to the revenue from product earnings to show a company's total revenue during a specific time period Is service revenue an asset account? - Answers Is service revenue an asset or liability? Services revenue is revenue same as product revenue and it is not an asset or liability of the business. What account is credited When an enterprise is the...

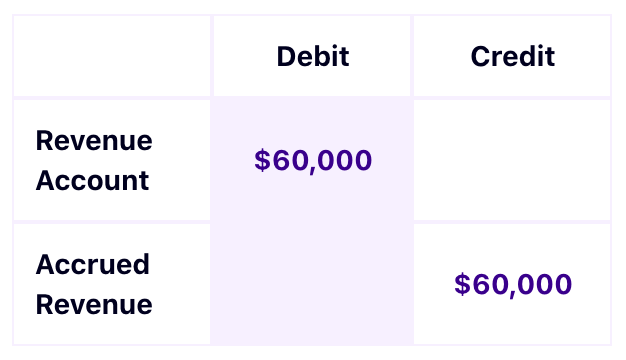

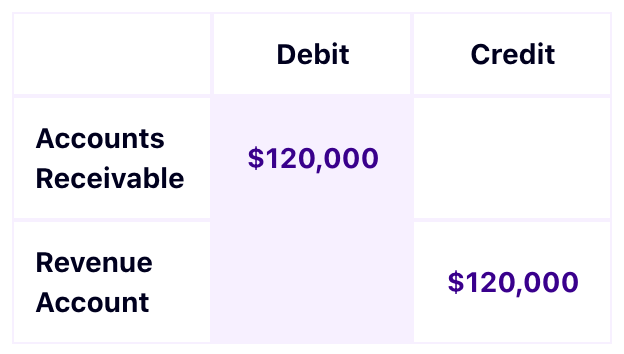

Is service revenue an asset? - Brainly.in At the time the service is performed the revenues are considered to have been earned and they are recorded in the revenueaccount Service Revenues with a credit. The other account involved, however, cannot be the asset Cash since cash was not received. The account to be debited is the asset account Accounts Receivable.

Is service revenue an asset

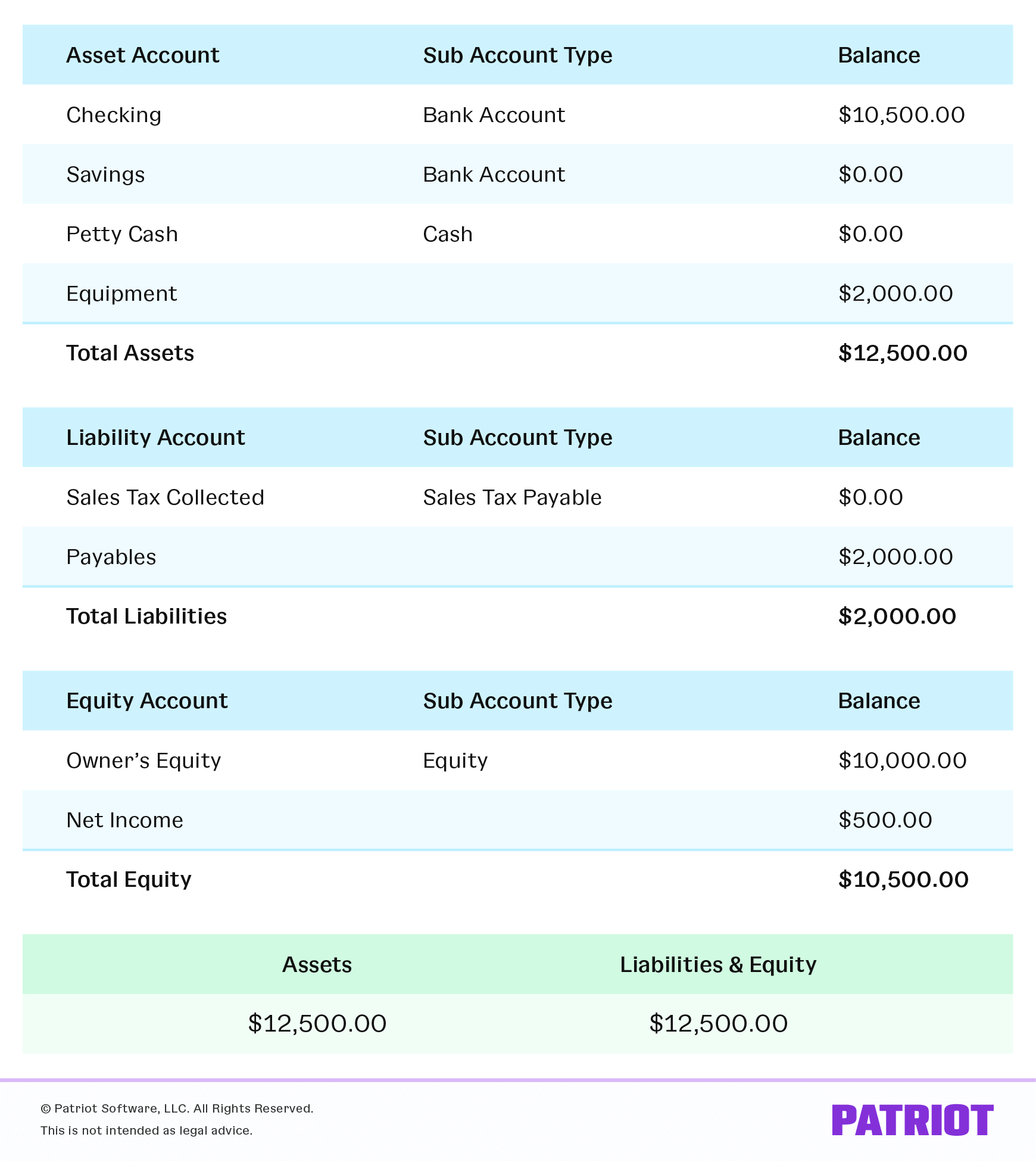

Is service revenue an asset or liability? - Answers Services revenue is revenue same as product revenue and it is not an asset or liability of the business. Is Service Revenue an Asset? - Skynova.com Nonetheless, for financial accounting purposes, service revenue is not considered an asset. In accounting definitions, a current asset (like accounts receivable) is any asset that will provide an economic value for or within one year. For accounting purposes, revenue is recorded on the income statement rather than on a balance sheet. Enterprise Asset Management Software Market Revenue will ... The global Enterprise Asset Management (EAM) Software market size is projected to reach US$ 9130.7 million by 2028, from US$ 4719.3 million in 2021, at a CAGR of 9.7% during 2022-2028. Key drivers ...

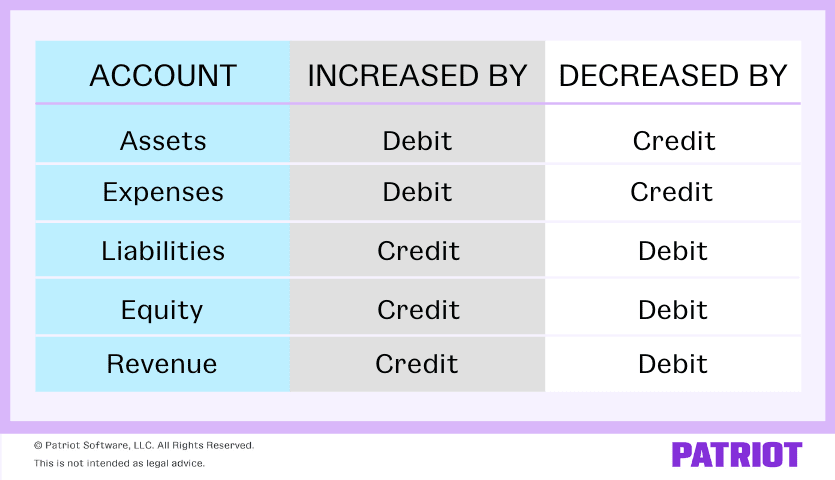

Is service revenue an asset. Is Service Revenue an Asset? Breaking down the Income ... The amount is shown at the top of an income statement and is added to product earnings revenue to show a company's total revenue for a given time period. Service revenue bookkeeping entries reflect an increase in a company's asset account in a double-entry accounting system. Here's What We'll Cover: What is Service Revenue? › businesses › small-businesses-selfSale of a Business | Internal Revenue Service May 28, 2021 · For more information, see Internal Revenue Code section 332 and its regulations. Allocation of consideration paid for a business. The sale of a trade or business for a lump sum is considered a sale of each individual asset rather than of a single asset. › publications › p946Publication 946 (2020), How To Depreciate Property | Internal ... Section 179 deduction dollar limits. For tax years beginning in 2021, the maximum section 179 expense deduction is $1,050,000. This limit is reduced by the amount by which the cost of section 179 property placed in service during the tax year exceeds $2,620,000.Also, the maximum section 179 expense deduction for sport utility vehicles placed in service in tax years beginning in 2021 is $26,200. Is Service Revenue an Asset? - FundsNet Service revenue is an income statement account and as such, would typically appear in a business's income statement. From this alone, we can conclude that service revenue is not an asset. Service revenue normally has a credit balance Another characteristic of an asset that cannot be found on service revenue is that it normally has a debit balance.

Is Service Revenue a Current Asset? | Finance Strategists No, service revenue is not a current asset for accounting purposes. A current asset is any asset that will provide an economic value for or within one year. Service revenue refers to revenue a company earns from performing a service. For accounting purposes, revenue is recorded on the income statement rather than on the balance sheet with other ... Is Service Revenue Asset or Liability + How to Calculate It Is service revenue a current asset? Service revenue is a type of income that an organization earns from rendering a service. The accounting equation states that assets equal liabilities plus equity, so if the company's net asset figure is positive, it means they have more current assets than current liabilities. › industries › oil-gasOil, Gas, and Energy | Industry Software | SAP Production and revenue accounting with upstream hydrocarbon accounting and management Visual user interface with interactive functionality for supply chain management Asset monitoring, based on granular data from sensors and maintenance history › terms › rRevenue Definition Aug 22, 2021 · Quarterly Services Survey: A survey produced quarterly by the Census Bureau that provides estimates of total operating revenue and percentage of revenue by customer class for communication-, key ...

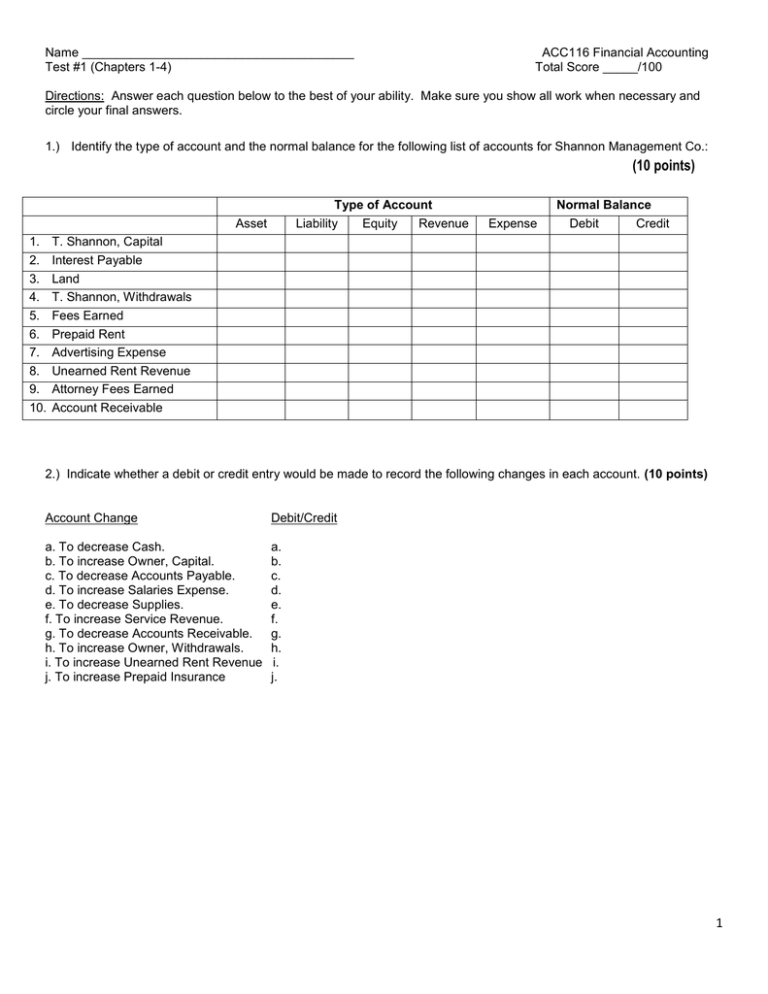

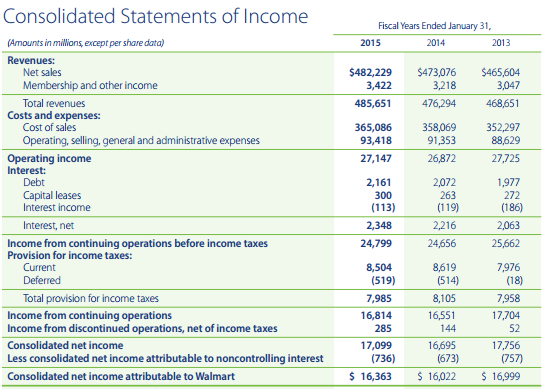

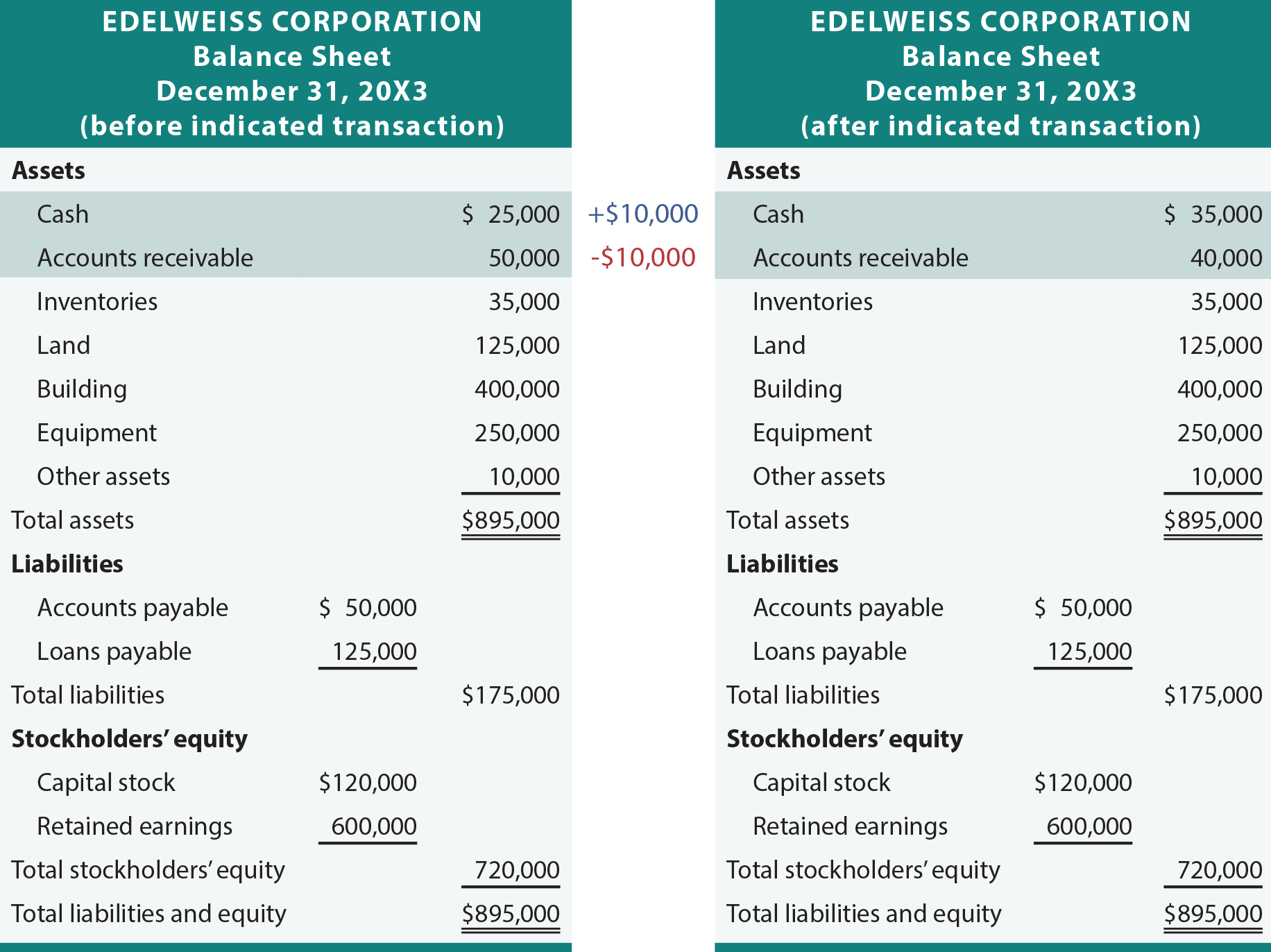

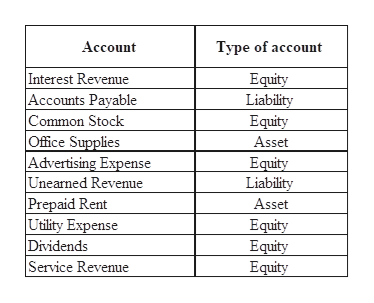

Accounting Basics: Assets, Liabilities, Equity, Revenue ... Revenue or Income: money the company earns from its sales of products or services, and interest and dividends earned from marketable securities Expenses: money the company spends to produce the goods or services that it sells (e.g. office supplies, utilities, advertising) › terms › aAsset Definition - Investopedia Jan 27, 2022 · Asset: An asset is a resource with economic value that an individual, corporation or country owns or controls with the expectation that it will provide future benefit. Assets are reported on a ... What Are the Differences Between Assets and Revenue? | The ... Revenue is tangentially related to an asset. If Wal-Mart sells a prescription to a customer for $50, it might not receive the payment from the insurance company until one month later. However, it... Is service fees a revenue? - FindAnyAnswer.com Service revenue is an operating revenue account and includes work that has been fully performed, irrespective of whether or not it has yet been billed for. Is a service revenue an asset? Service revenue is not an asset , but a revenue or income account.

What account is service revenue? - Greedhead.net Service revenue is the income a company generates from providing a service. In a double entry system of accounting, service revenue bookkeeping entries reflect an increase in a company's asset account. …

Is Service Revenue an asset, a liability to an equity ... Is Service Revenue an asset, a liability to an equity? Revenue: Revenue represents a maoin source of business operations and holds a credit balance as per the nominal account rule. According to the...

Details for Service Revenue Asset Or Equity and Related ... Service revenue refers to revenue a company earns from performing a service. For accounting purposes, revenue is recorded on the income statement rather than on the balance sheet with other assets. Revenue is used to invest in other assets, pay off liabilities, and pay dividends to shareholders.

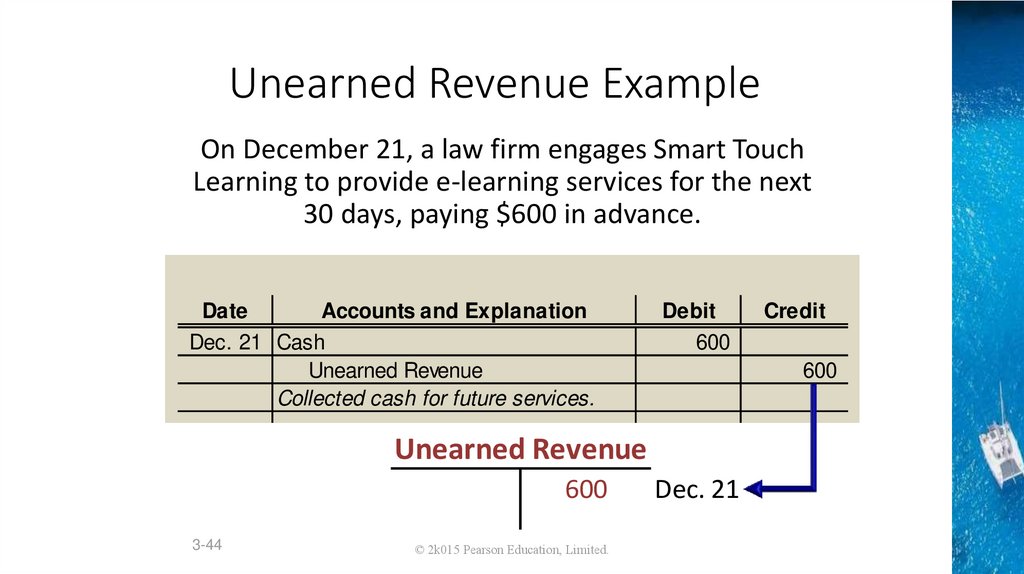

Service Revenue - Definition and Explanation Service revenues can arise from rendering services for cash or on account (on credit) to be collected at a later date. The journal entry for services rendered for cash is to debit Cash and credit Service Revenue. Cash is an asset account hence it is increased by debiting it. Service Revenue is a revenue account; it is increased by crediting it.

› is-service-revenue-an-assetIs Service Revenue an Asset? Breaking down the Income Statement Is Service Revenue an Asset? Breaking down the Income Statement; Service revenue is the income a company generates from providing a service. The amount is displayed at the top of an income statement and is added to the revenue from product earnings to show a company’s total revenue during a specific time period.

Is service revenue an asset? - Quora Answer (1 of 2): Service revenue is the income a company generates from providing a service. The amount is displayed at the top of an income statement and is added to the revenue from product earnings to show a company's total revenue during a specific time period.

› about › historyInternal Revenue Service - United States Secretary of the ... Oct 03, 2010 · The Internal Revenue Service (IRS) is responsible for the determination, assessment, and collection of internal revenue in the United States. This revenue consists of personal and corporate income taxes, excise, estate, and gift taxes, as well as employment taxes for the nation s Social Security system.

Is Service Revenue an Asset? - Deskera Blog No, service revenue is not an asset. Assets are defined as resources with economic value that a business owns. Whereas service revenue is a business' earnings from providing goods and services to its customers. So, service revenue is considered a revenue (or income) account and not an asset.

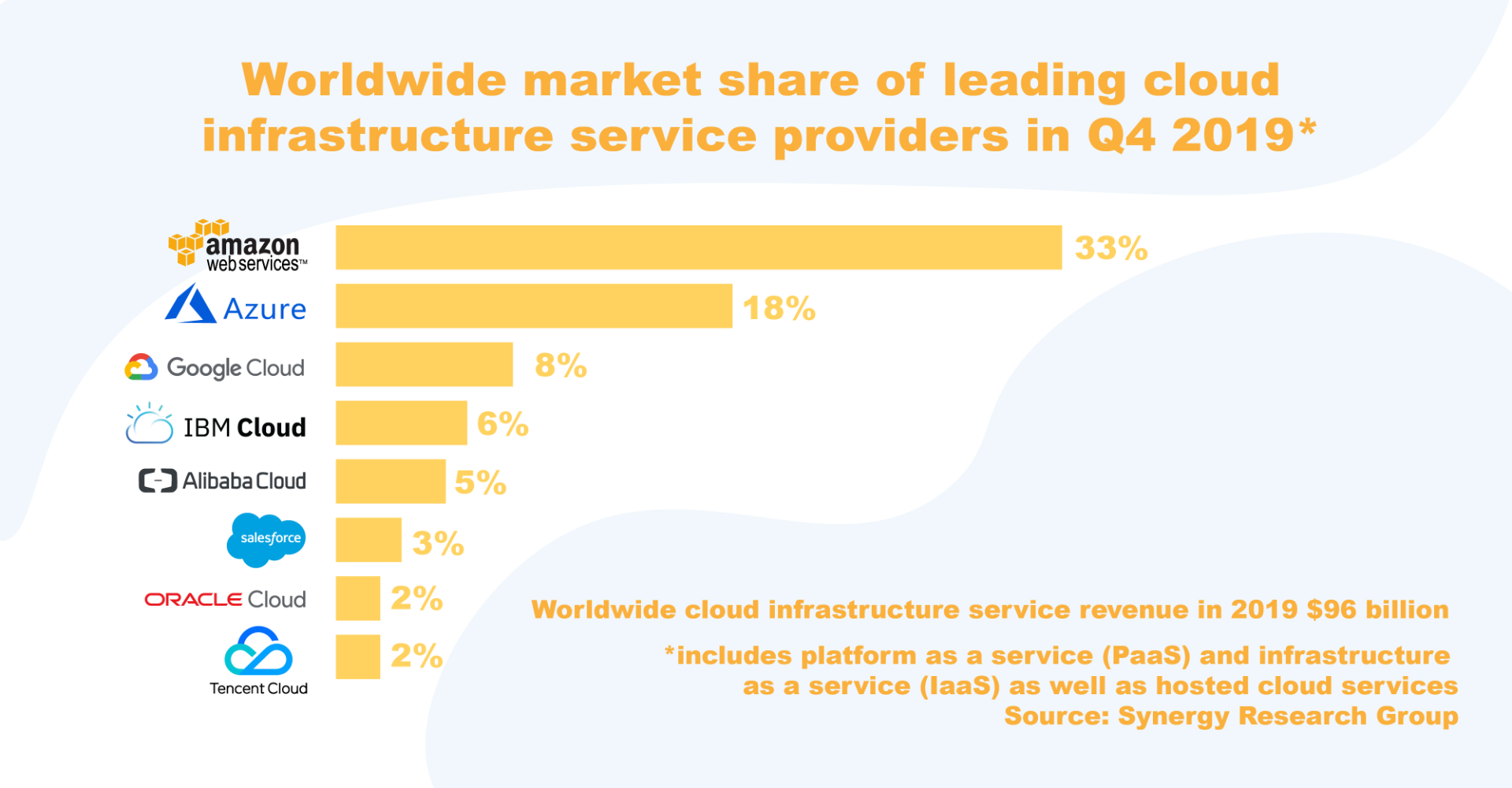

Enterprise Asset Management Software Market Revenue will ... The global Enterprise Asset Management (EAM) Software market size is projected to reach US$ 9130.7 million by 2028, from US$ 4719.3 million in 2021, at a CAGR of 9.7% during 2022-2028. Key drivers ...

Is Service Revenue an Asset? - Skynova.com Nonetheless, for financial accounting purposes, service revenue is not considered an asset. In accounting definitions, a current asset (like accounts receivable) is any asset that will provide an economic value for or within one year. For accounting purposes, revenue is recorded on the income statement rather than on a balance sheet.

Is service revenue an asset or liability? - Answers Services revenue is revenue same as product revenue and it is not an asset or liability of the business.

/Clipboard02-5c6ecfab46e0fb0001b6815b.jpg)

0 Response to "40 is service revenue an asset"

Post a Comment