40 the formula for depreciable cost is

› straight-line-depreciation-formulaStraight Line Depreciation Formula | Calculator (Excel template) Straight Line Depreciation Formula allocates the Depreciable amount of an asset over its useful life in equal proportion. The straight Line Depreciation formula assumes that the benefit from the asset will be derived evenly over its useful life. What is the Depreciable Value of Fixed Asset? ( Example ... Depreciable value = ( (60,000 + 15,000) - 5000) = $70,000 In the 2 nd year, the POQ Limited, reassessed the salvage value as $ 10,000, the depreciable value can be calculated for the year1 as below: Depreciable value = ( (60,000 + 15,000) - 10,000) = $ 65,000 ← Previous Post Next Post →

Income Tax Folio S3-F4-C1, General Discussion of ... - Canada 20.11.2018 · Important notice. On November 21, 2018, the Department of Finance issued the Fall Economic Statement 2018 which contains proposed changes to the capital cost allowance (the “CCA”) rules that affect certain depreciable property acquired after November 20, 2018.. Depreciable property impacted by the proposed changes is referred to as Accelerated …

The formula for depreciable cost is

EECE 450 — Engineering Economics — Formula Sheet B= initial (purchase) value or cost basis S= estimated salvage value after depreciable life dt= depreciation charge in year t N= number of years in depreciable life Book value at end of period t: BV t = B −∑ = t i di 1 Straight-Line (SL): Annual charge: dt = (B – S)/N Book value at end of period t: BV t = B − t ×d Sum-of-Years ... What is the formula for depreciable cost? - Greedhead.net Read on to know depreciation expense formula for SLD: Annual Depreciation Expense = (Cost of an asset - Salvage Value)/Useful life of an asset Cost of the asset is said to be a purchase price or historical cost Salvage value is the value of the asset remaining after its useful life Which is an example of a depreciable cost? Declining Balance Depreciation Calculator Calculator Use. Use this calculator to calculate an accelerated depreciation of an asset for a specified period. A depreciation factor of 200% of straight line depreciation, or 2, is most commonly called the Double Declining Balance Method.Use this calculator, for example, for depreciation rates entered as 1.5 for 150%, 1.75 for 175%, 2 for 200%, 3 for 300%, etc.

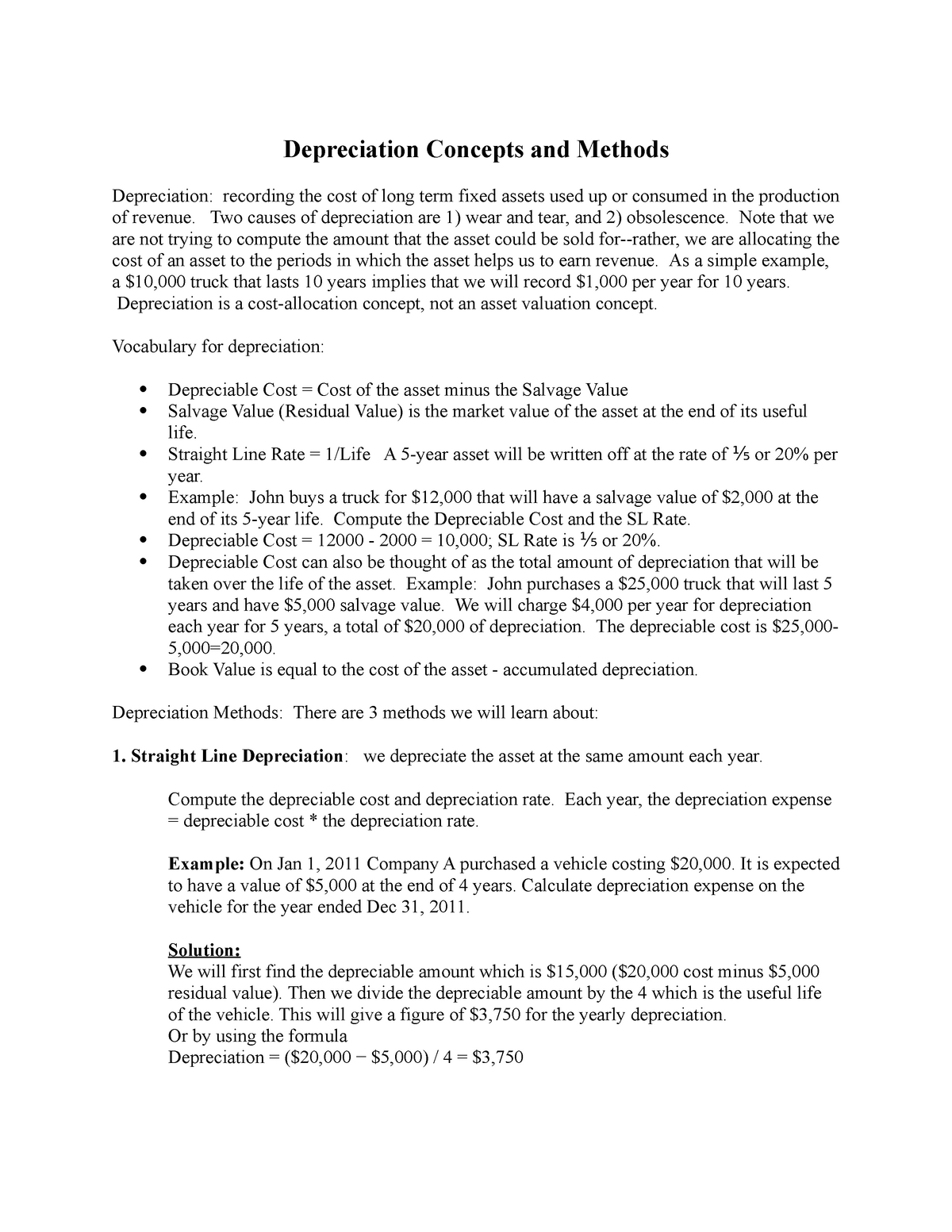

The formula for depreciable cost is. Revised Depreciation | Calculation | Journal Entry ... The company can calculate the revised depreciation by determining the remaining depreciable cost with the formula of deducting the accumulated depreciation and salvage value at the revision date from the original cost of the fixed asset. And then divide the remaining depreciable cost with the remaining useful life to determine the revised ... What is the formula to calculate depreciation ... First subtract the asset's salvage value from its cost, in order to determine the amount that can be depreciated. Total depreciation = Cost - Salvage value. … Annual depreciation = Total depreciation / Useful lifespan. … Monthly depreciation = Annual deprecation / 12. … Monthly depreciation = ($1,200/5) / 12 = $20. Depreciation of Vehicles - atotaxrates.info 27.01.2022 · * Assets acquired since 10 May 2006 may use a diminishing value rate equivalent to double the prime cost rate. Car Depreciation Cost Limit. The depreciable cost of motor vehicle is subject to the Luxury Car Limits, which assumes an upper limit on the cost on which depreciation is calculated.If the vehicle costs more than the limit, depreciation is only … What is Depreciable Value? | Formula | Example ... Book Value Formula. Book Value = Initial Cost - Accumulated Depreciation. For example, on Jan 202X, company purchase an asset costs $ 50,000 and expects to use it for 5 years and the salvage value is $ 5,000. Depreciable value = 50,000-5,000 = $ 45,000. Depreciation Expense = 45,000/5 = $9,000 per years

depreciable cost definition and meaning | AccountingCoach V W X Y Z depreciable cost definition The amount of an asset's cost that will be depreciated. It is the cost minus the expected salvage value. For example, if equipment has a cost of $30,000 but is expected to have a salvage value of $3,000 then the depreciable cost is $27,000. Join PRO or PRO Plus and Get Lifetime Access to Our Premium Materials (Get Answer) - The formula for depreciable cost is a ... The formula for depreciable cost is a. Initial Cost - Residual Value Ob. Initial Cost - Accumulated Depreciation Oc. Depreciable Cost = Initial Cost Od. Initial Cost + Residual Value What is the formula for straight-line depreciation ... Subtract the estimated salvage value of the asset from the cost of the asset to get the total depreciable amount. Determine the useful life of the asset. How to calculate depreciation on an asset in Excel? Suppose an asset for a business cost $11,000, will have a life of 5 years and a salvage value of $1,000. The formula for depreciable cost is a initial cost ... The formula for depreciable cost is a initial cost residual value b initial cost | Course Hero The formula for depreciable cost is a initial cost 31.

Common Depreciable Property Classes | 2022 TurboTax ... 25.01.2021 · Instead, the CRA allows you to write off a portion of the item’s depreciable value over a period of several years by claiming Capital Cost Allowance (CCA). However, there is no set formula to determine this value. Instead, the CRA groups assets into different classes depending on a variety of factors. What Can Be Depreciated in Business? Depreciation Decoded Low-cost items with a short lifespan are recorded as business expenses. You can write off these expenses in the year they were incurred. For example, office supplies are expense items while a printer, that you would use for a longer period, is a fixed asset that depreciates every year. Which Asset Does Not Depreciate? All depreciable assets are fixed assets but not all fixed assets … Formula for depreciable cost? - Answers Depreciable Value = Intial Cost - Residual Value. In the US, the answer depends on what depreciable assets you are talking about.Depreciation on any depreciable asset that is directlyused in the ... How To Depreciate Assets Using The Straight | Simple ... Straight Line Depreciation Formula. Over the useful life of an asset, the value of an asset should depreciate to its salvage value. It is calculated by simply dividing the cost of an asset, less its salvage value, by the useful life of the asset. This is very important because we need to calculate depreciable values or amounts.

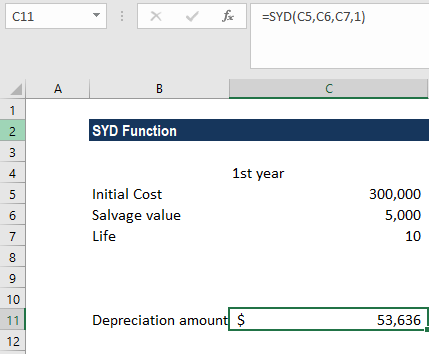

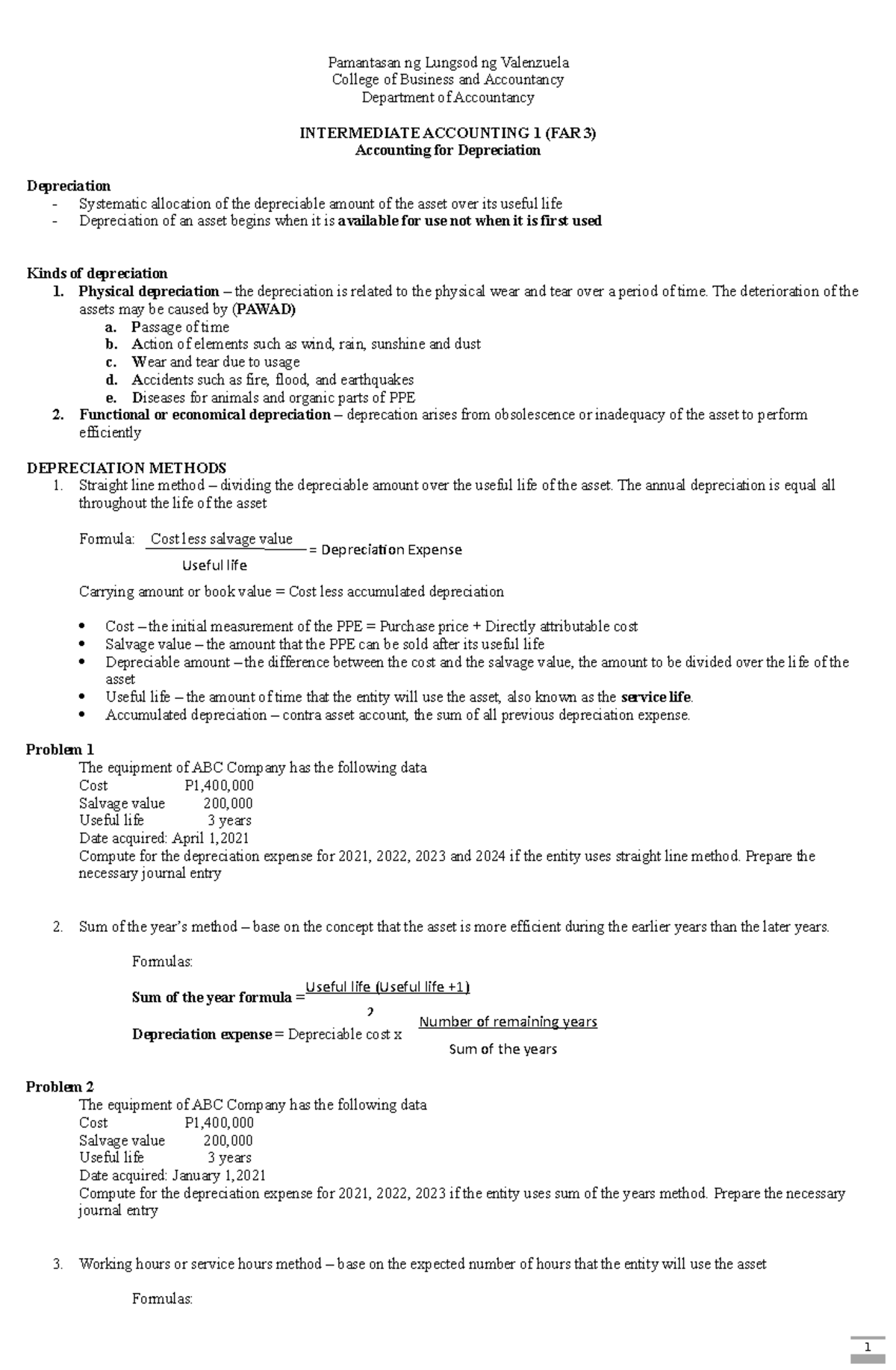

Depreciation - Wikipedia The formula to calculate depreciation under SYD method is: SYD depreciation = depreciable base x (remaining useful life/sum of the years' digits) depreciable base = cost − salvage value Example: If an asset has original cost of $1000, a useful life of 5 years and a salvage value of $100, compute its depreciation schedule. First, determine the years' digits. Since the asset …

› businesses › cost-segregation-auditCost Segregation Audit Techniques Guide - Chapter 5 - Review ... In the case of an acquisition including a combination of depreciable and non-depreciable property for a lump sum (e.g., buildings and land), the basis for depreciation cannot exceed an amount which bears the same proportion to the lump sum as the value of the depreciable property at the time of acquisition bears to the value of the entire ...

Depreciable Cost: What Does Depreciable Cost Mean? Depreciation costs, also known as net book value, is the cost of an asset less accumulated depreciation. Depreciation cost = Purchase price of an asset - Cumulative depreciation Depreciation expense or depreciation costs is the amount of depreciation that is reported on the income statement.

Depreciated Cost - Overview, How To Calculate ... Thus, at the end of 2019, the accumulated depreciation is $14,250 ($4,750 * 3), and the depreciated cost is $95,750 ($110,000 - $14,250). At the end of the useful life of the asset, the accumulated depreciation will be $95,000 ($4,750 * 20). The depreciated cost will be $15,000 ($110,000 - $95,000), equal to the salvage value .

What is depreciable cost formula? - Greedhead.net Depreciation = (Asset Cost - Residual Value) / Useful Life of Asset Under the unit of production method, the formula for depreciation is expressed by dividing the difference between the asset cost and the residual value by the life-time production capacity which is then multiplied by the no. of units produced during the period.

Solved 1.All of the following are needed for the ... - Chegg 3.The formula for depreciable cost is a.Initial Cost - Accumulated Depreciation b.Initial Cost - Residual Value c.Initial Cost + Residual Value d.Depreciable Cost = Initial Cost 4.Which of the following is an example of a capital expenditure? a.cleaning the carpet in the front room b.replacing an engine in a company car

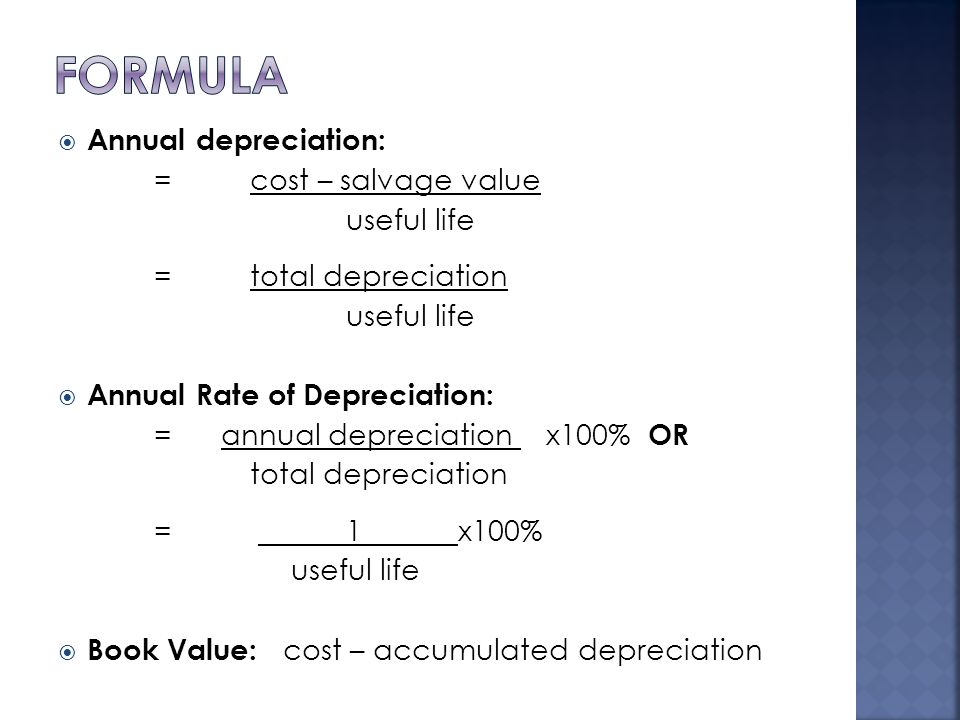

Depreciation Formula | Calculate Depreciation Expense There are primarily 4 different formulas to calculate the depreciation amount. Let's discuss each one of them - Straight Line Depreciation Method = (Cost of an Asset - Residual Value)/Useful life of an Asset. Diminishing Balance Method = (Cost of an Asset * Rate of Depreciation/100)

Uncover All Hidden Lifecycle Ownership Costs. Find TCO in ... Total Cost of Ownership TCO Definition. Total cost of ownership TCO is a form of cost analysis that aims to uncover all the likely costs that follow from owning certain kinds of assets or certain acquisitions during ownership life.. TCO analysis attempts to reveal and summarize ownership costs that are obvious and known to all before purchase, but also the full range of …

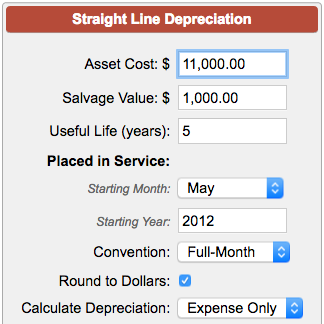

Depreciable cost definition — AccountingTools Therefore, the depreciable cost of the machine is $8,000, which is calculated as follows: $10,000 Purchase price - $2,000 Salvage value = $8,000 Depreciable cost The company then uses a depreciation method, such as the straight-line method, to gradually charge the $8,000 depreciable cost to expense over the useful life of the machine.

Remaining depreciable value - MATLAB deprdv This example shows how to find the remaining depreciable value after six years for the cost of an asset for $13,000 with a life of 10 years. The salvage value is $1000. Accum = depstln (13000, 1000, 10) * 6. Accum = 7200. Value = deprdv (13000, 1000, 7200) Value = 4800.

Depreciable Value: Definition, Example, Calculation ... Once companies obtain these figures, they can calculate the depreciable value with the formula below. Depreciable value = Cost - Salvage value. Example. A company, Red Co., acquires a manufacturing machine. The company pays $10,000 to its supplier. On top of that, it also incurs transportation costs of $3,000 on it.

Ch 10 Quiz Flashcards | Quizlet The formula for depreciable cost is a. Initial Cost + Residual Value b. Depreciable Cost = Initial Cost c. Initial Cost - Accumulated Depreciation d. Initial Cost - Residual Value d. the units-of-activity method

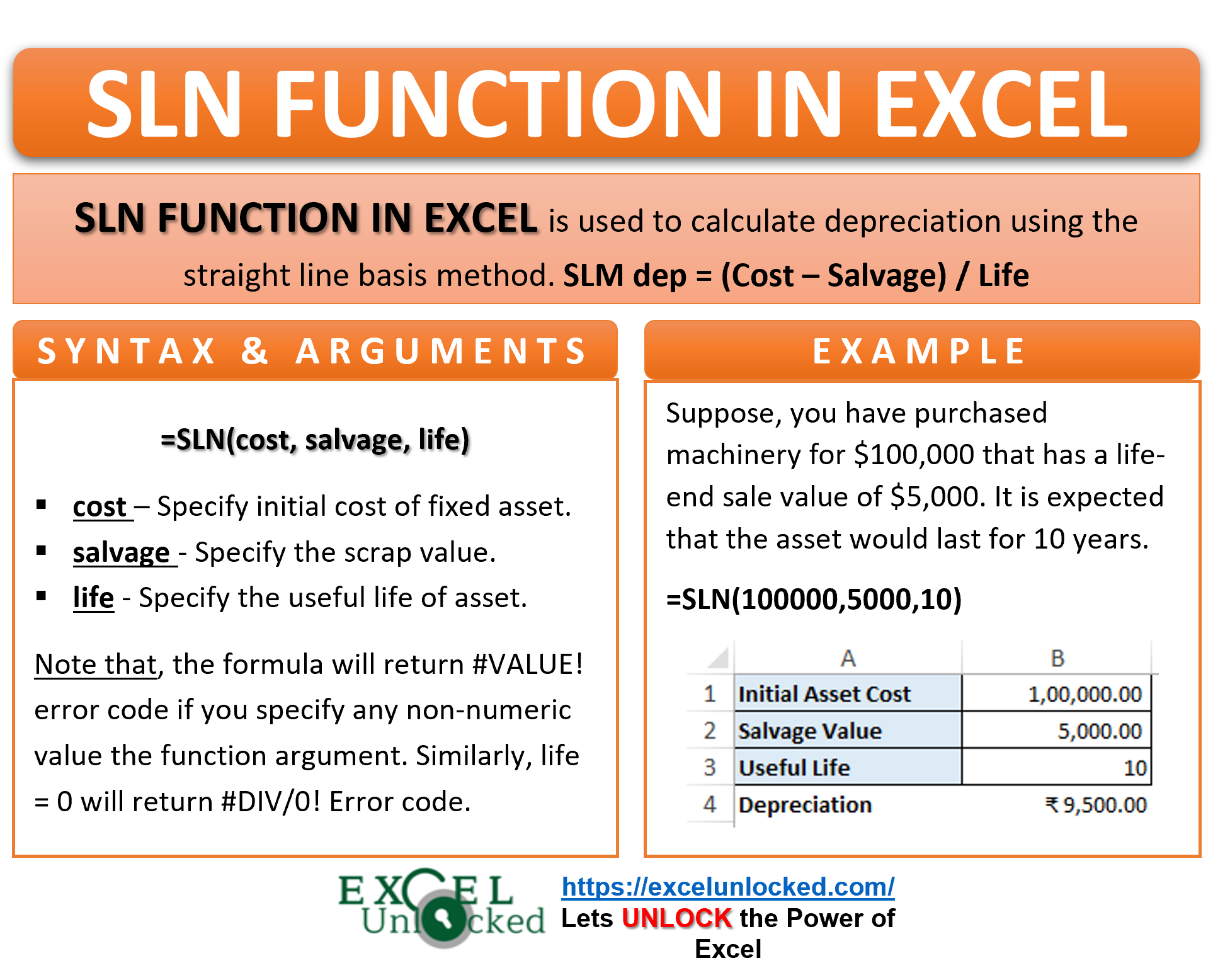

What is a Depreciable Cost? - Definition | Meaning | Example Straight-line depreciation is calculated by dividing the depreciable cost by the useful life of the asset. In our plant asset example, the straight-line depreciation per year would be $9,500 ($95,000 / 10 years). This means the assets recognize $9,500 of cost per year for ten years. A B C D E F G H I J K L M N O P Q R S T U V W X Y Z

› en › revenue-agencySelf employed Business, Professional, Commission ... - Canada Since land is not depreciable property, he has to calculate the part of the expenses connected with the purchase that relates only to the building. To do this, he has to use the following formula, explained under the heading Land. $75,000 ÷ $90,000 × $5,000 = $4,166.67

ACCT CHAPTER 10 QUIZ Flashcards | Quizlet The formula for depreciable cost is a.Initial Cost - Residual Value b.Initial Cost - Accumulated Depreciation c.Depreciable Cost = Initial Cost d.Initial Cost + Residual Value. A. The natural resources of some companies include a.metal ores, copyrights, and supplies b.minerals, trademarks, and land

Salvage Value Definition 12.10.2021 · An asset's depreciable amount is its total accumulated depreciation after all depreciation ... ($5,000 cost - $1,000 salvage value) / 5 years, or …

What is the formula to calculate depreciation ... First subtract the asset's salvage value from its cost, in order to determine the amount that can be depreciated. Total depreciation = Cost - Salvage value. … Annual depreciation = Total depreciation / Useful lifespan. … Monthly depreciation = Annual deprecation / 12. … Monthly depreciation = ($1,200/5) / 12 = $20.

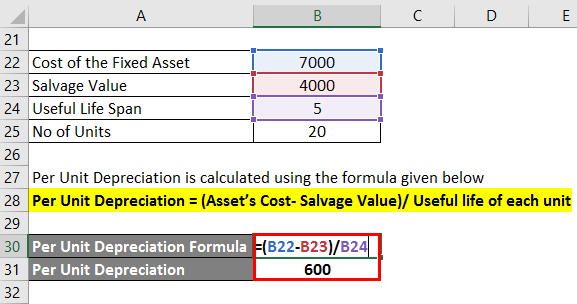

Calculate units of production depreciation | Example ... Depreciable cost = Cost of fixed asset - Salvage value of fixed asset Estimated units of useful life are the estimated total production units that the fixed asset can produce during its useful life. There may be a variety of measurement units for this figure, such as hour, mile or unit, etc. based on the type of fixed asset the company owns.

Solved The formula for depreciable cost is Initial cost ... Question: The formula for depreciable cost is Initial cost - Accumulated depreciation Depreciable cost = Initial cost Initial cost + Residual value Initial cost - Residual value This problem has been solved! See the answer 16 Show transcribed image text Expert Answer 100% (2 ratings) Ans. Option 4th Initial cost - Residual value Ex …

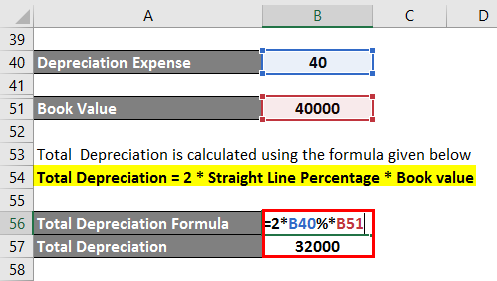

calculators.io › double-declining-depreciationDouble Declining Depreciation Calculator - [100% Free ... The first things to know when implementing the double declining depreciation formula are the asset’s useful life and purchase price. The Purchase Price refers to the original value of your asset or the depreciable cost. The Useful Life refers to the expected time that the asset will be productive for its expected purpose.

Depreciated Cost Definition - Investopedia Depreciated Cost = Purchase Price (or Cost Basis) − CD where: CD = Cumulative Depreciation Example of Depreciated Cost If a construction company can sell an inoperable crane for parts at a price...

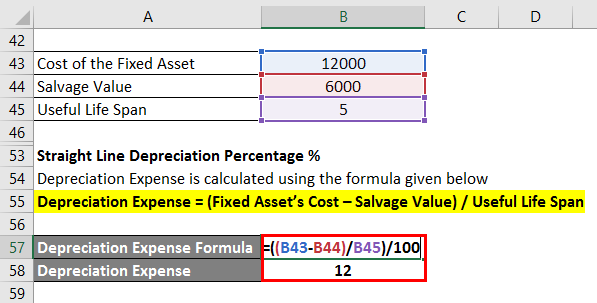

Straight Line Depreciation - Formula & Guide to Calculate ... The depreciation rate is the annual depreciation amount / total depreciable cost. In this case, the machine has a straight-line depreciation rate of $16,000 / $80,000 = 20%. Note how the book value of the machine at the end of year 5 is the same as the salvage value.

Cost Segregation ATG Chapter 6 2 Change in Accounting ... A change in the treatment of an asset from non-depreciable or non-amortizable to depreciable or amortizable, or vice versa, Treas. Reg. § 1.446-1(e)(2)(ii)(d)(2); A correction to require depreciation in lieu of a deduction for the cost of depreciable or amortizable assets that had been consistently treated as an expense in the year of purchase, or vice versa, Treas. Reg. § …

Unit Of Production Depreciation Method Formula, Examples ... Its depreciable cost equals $15,000, or $25,000 minus the $10,000 salvage value. Practically it is challenging to calculate depreciation under this method due to complexity. For example, there are multiple assets, and each asset produces different units in a particular year.

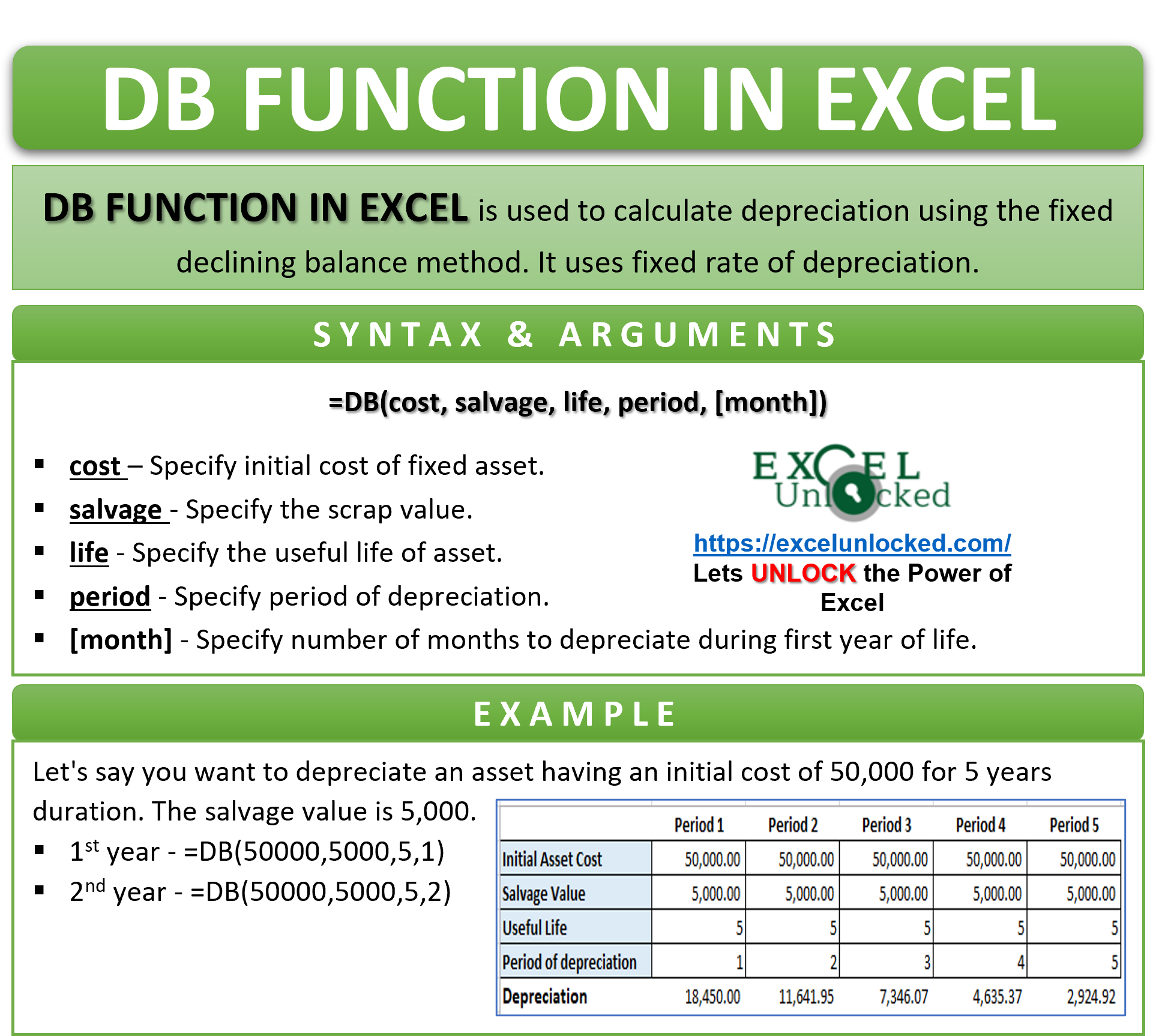

Declining Balance Depreciation Calculator Calculator Use. Use this calculator to calculate an accelerated depreciation of an asset for a specified period. A depreciation factor of 200% of straight line depreciation, or 2, is most commonly called the Double Declining Balance Method.Use this calculator, for example, for depreciation rates entered as 1.5 for 150%, 1.75 for 175%, 2 for 200%, 3 for 300%, etc.

What is the formula for depreciable cost? - Greedhead.net Read on to know depreciation expense formula for SLD: Annual Depreciation Expense = (Cost of an asset - Salvage Value)/Useful life of an asset Cost of the asset is said to be a purchase price or historical cost Salvage value is the value of the asset remaining after its useful life Which is an example of a depreciable cost?

EECE 450 — Engineering Economics — Formula Sheet B= initial (purchase) value or cost basis S= estimated salvage value after depreciable life dt= depreciation charge in year t N= number of years in depreciable life Book value at end of period t: BV t = B −∑ = t i di 1 Straight-Line (SL): Annual charge: dt = (B – S)/N Book value at end of period t: BV t = B − t ×d Sum-of-Years ...

/straight-line-depreciation-method-357598-Final-5c890976c9e77c00010c22d2.png)

:max_bytes(150000):strip_icc()/JCPIncomestatementMay2019Investopedia-ef93846733094d2cbd1fdfe97126b3bc.jpg)

0 Response to "40 the formula for depreciable cost is"

Post a Comment